Christy Clark’s climate plan is a lot of hot air. John Horgan’s isn’t.

It’s one of the fundamental challenges of this generation.

Tackling climate change in a meaningful way should be a no-brainer for political leaders. It preserves our environment, protects jobs and human lives, and grows the economy. Yet, time and again, political leaders stand up and say we can’t do both. That addressing climate change and protecting jobs can’t happen at the same time. It’s something Christy Clark says year after year when she refuses to raise the carbon tax and commit to ambitious emission reduction targets.

That’s, quite frankly, total malarkey.

Joe Biden says it better than we can.

Balancing bold emission cuts and protecting families from big tax hikes can be done. It just takes leadership.

John Horgan’s Clean Growth Climate Action plan would do just that for British Columbia. It would get the province back on track to meet our climate targets, stimulate innovation, create jobs, protect BC businesses, support rural communities and use new carbon tax revenues to put more money back in the pockets of low and middle income families.

The plan is built on five principles.

#1 - Take measures to reduce carbon pollution.

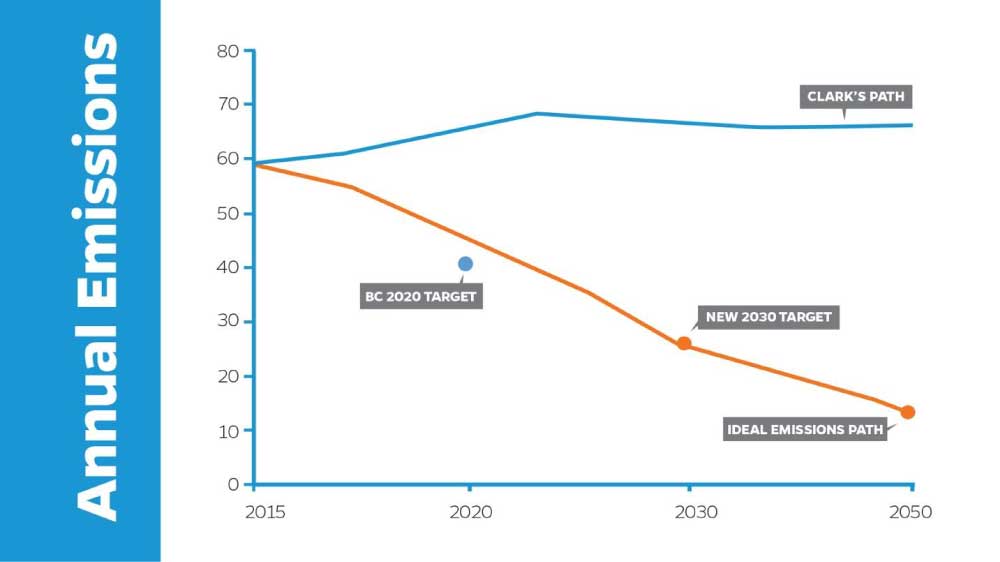

Ultimately, climate plans should be judged on one simple test: are your emissions going up, or down? John Horgan’s plan commits to achieve BC’s legislated 2050 greenhouse gas emission reduction target of 80 per cent below 2007 levels and sets a new legislated 2030 reduction target of 40 per cent below 2007 levels.

#2 – Gradually and predictably bring in the federally mandated carbon price so BC can prepare.

Rather than hit people with a large increase all at once, our plan will meet the federally mandated $50/tonne carbon price by 2022 over three years starting in 2020.

#3 – Make the carbon tax more affordable for families (and less friendly to industry).

Taking climate action should benefit people, not burden them. John Horgan’s plan will create a new climate action rebate cheque for low and middle income families so that 80 per cent of households would receive the rebate cheque each year, in advance.

Under Christy Clark the carbon tax is regressive and unfair. Her government gives corporations and businesses big tax breaks – sometimes as much as 65 per cent – leaving regular people paying more than their share.

It’s a broken system that isn’t helping. We’ll fix it.

#4 – Invest carbon tax revenues in creating jobs, growing the economy and climate solutions.

An essential element to any successful climate plan is investing in initiatives and infrastructure that actually reduce carbon pollution.

That’s a fundamental difference between John Horgan’s plan and Christy Clark’s. His invests a portion of carbon tax revenues directly into reducing emissions and climate change solutions – like transit, energy efficiency, clean technology and other initiatives that reduce our dependence on fossil fuels.

#5 – Take a sector-by-sector approach to regulating carbon pollution reduction.

Different industries generate CO2 emissions in different ways. John Horgan’s plan will establish separate reduction goals and reduction plans for transportation (30 per cent reduction by 2030), industry (30 per cent reduction by 2030) and buildings and homes (50 per cent reduction by 2030).

So, how does the BC NDP’s plan stacks up with Christy Clark’s climate strategy? Well…

Christy Clark’s commitment to addressing climate change is best illustrated by how she treated her Climate Leadership Team.

In 2015 she brought together a committee of climate experts to help develop British Columbia’s next generation climate strategy. They spent a year working on it. They presented a bold vision for how BC could be a real leader in carbon emission reduction.

She ignored it.

After six months – and one scathing public letter – Clark finally released the report. Then she announced she wasn’t going to implement any of it.

Christy Clark’s election promises are more of the same. She won’t raise the carbon tax. She will let emissions keep rising. She’ll keep giving industry big tax breaks – and even bigger subsidies, while families pay more than their fair share.

BC can't wait another four years to take real climate action.We’re ready to roll up our sleeves and get to work.

To see our full platform, click here.